Are you in search for a tutorial on how to activate/confirm your AMEX credit card. If you are also one among those who are searching on how you can activate your AMEX credit card easily, then you are the right place as today we bring you a detailed guide on the same.

American Express is an US-based company offering financial services to customers and one of their well-known service offerings are credit cards. The credit cards issued by American Express are commonly referred as “AMEX” cards and as American Express is one of the biggest financial service providers in the US, most of the people living in the United States have an AMEX credit card.

About American Express

As we mentioned at the beginning, American Express is one of the largest financial service provider in the United States. American Express has a presence not only in the United States but has a very popular presence in many locations around the world as well.

The company was found back in 1850 and the headquarters of American Express is situated in

Buffalo, New York.

As per reports from 2016, the American Express credit card services amounted to 22.9 percent of all dollar volume transactions in the United States. As per reports from 2017, there are more than 112 million American Express credit cards out there, out of which over 50 million are present in the United States itself with an estimated annual spending of over $18,000.

Features of American Express Credit Cards

If you are new to AMEX credit cards, then below are some of the highlight features of the American Express credit cards.

- Official AMEX mobile app to monitor spending and schedule payments.

- Earn points for using the credit card on eligible purchases and spend the points for coupons and other offers.

- Easy access to credit scores 24/7.

- Easily report any fraudulent credit card transactions or in case your credit card gets stolen. You can report and even block your AMEX credit card by contacting AMEX customer care or even from within your AMEX mobile app.

Eligibility Criteria to Apply for American Express Credit Cards

If you are planning to apply for an American Express credit card, then below are the basic eligibility criteria to be approved for any AMEX credit card.

-

- You must be over 18 years in age.

- You must have a credit score of “Good” or above.

- There should be no lawsuits filed against you by any financial institutions.

Top American Express Credit Cards

Now that you know the features of American Express Credit Cards, below we have listed out some of the widely popular AMEX credit cards.

American Express Platinum Edge Credit Card

The American Express Platinum Edge credit card some with an annual fee of $195 and an interest rate of 20.74 per annum. The first 55 days after issuing the credit card is an interest-free period and you won’t be charged interest for purchases during that period.

The AMEX Platinum Edge credit card is best American Express travel credit card and it comes with $200 worth of travel credits per annum. You can also get domestic and international travel insurance, provided you also book your return ticket using this credit card.

American Express Velocity Platinum Credit Card

The American Express Velocity Platinum credit card has an annual fee of $375 per annum and the interest rate charged on purchases is 20.74 percent. Apart from an introductory interest-free period of 55 days, this credit card also offers its owners with 2 complimentary access to the airport lounge of Virgin Australia at selected airport and complimentary return domestic economy flight ticket on Virgin Australia between selected cities.

Also, when you make eligible travel ticket purchases, you also get complimentary travel insurance for both domestic and international travel.

American Express Essential Credit Card

The American Express Essential credit card is one of the most popular AMEX credit cards out there mainly because of the reason that this credit card comes with $0 annual fee making it perfect for everyday use.

The interest rate charged per annum is also really competitive at 14.99 percent and there is also an introductory no-interest period of 55 days. For every dollar spent using the credit card, 1 AMEX Membership Rewards point will be rewarded and if you purchase your Smartphone or pay for the Smartphone contract using your credit card, then you can get insurance for your Smartphone for up to $500.

How to Activate/Confirm your AMEX Credit Card?

Once you apply for and receive your American Express credit card, the next process is to activate the credit card. It is very easy to activate/confirm AMEX credit card as it can be done online at any time of the day.

Below is a step-by-step guide on how to activate/confirm AMEX credit card easily from anywhere in the world.

- First of all, you need to open the official American Express Credit Card Activation webpage on your web browser. To load the American Express Credit Card Activation webpage, click here.

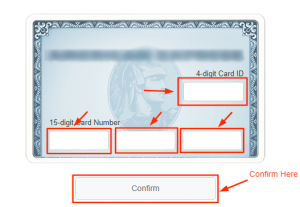

- Once the webpage loads, it will ask for two numbers that are present on your AMEX credit card. The first number required is of 4-digits and can be found on the card above the card number. The second number is of 15-digits and is the actual card number itself.

- After you enter both the numbers, click on the “Next” button.

- Now, you will have to create a new account for your AMEX credit card. Fill in a new username and password for your account along with a security question and its answer.

Once you complete signing up for a new account, your AMEX credit card activation will be successfully completed and you can then begin using the credit card.

Other AMEX cards

- American Express gold card

- American Express Platinum Charge Card

- The American Express Platinum Travel Credit Card and more

- The given above cards are those cards which are available for the people in the terms of providing them the services

- Premium Credit Card

American Express Support Phone Numbers:

Below in this post, we are going to give you the customer service phone number of the www americanexpress.com/confirmcard, which is available 24*7 for your help.

- 1-800-954-0559 (Domestic)

- 1-801-449-4019 (International)

Final Words

We believe that the above article on American Express, American Express credit cards, and how to activate/confirm AMEX credit card was informative and helpful to you.

If you have any questions in your mind relating to American Express or any services that they offer, feel free to leave a comment below with your query and we will respond back to you.

Here is the quick video :

FAQ

How does Amex spending power work?

Go to the website and click on the “Check spending power” tools to know more about it.

How do you get an American Express Credit Limit Increase?

You can request a credit limit increase from the official website or by the phone on 1-800-528-4800.

For the website, follow these steps.

- You need to login to your American Express account on the official website.

- Click on the “Account Service” link.

- Find the box that says “Credit Management”

- Select “Increase Line of Credit”

- You need to enter your four-digit security code which can be found above your card number.

- Now enter your preferred credit limit along with your income.

- Now, wait for the approval.

You need to wait at least 60 days after getting your new American Express card. If your request is denied, you need to wait 90 days for a new request. If approved, you need to wait 6 months to increase your credit limit again.

How much are American Express foreign transaction fees?

The American express foreign transaction fees are 2.7% on all transactions. Amex foreign transaction fees applied when you buy things outside the country or from the merchant.

What are the best American Express car rental discounts?

American express offers discounts to its cardholder up to 15% to 25% on all top 6 car renting companies. They also offer vehicle upgrades and membership.

How does the American Express extended warranty benefit work?

American express card extends warranty up to 2 years on purchasing with the card. American express matches the original warranty is shorter than 2 years and adds 2 years to any original warranty of between 2 and 5 years.

American express card extended warranty cover of cardholder up to 10,000$ per item or 50,000$ per year. They will pay to repair or replace any item depending on whichever is cheaper.